Contents:

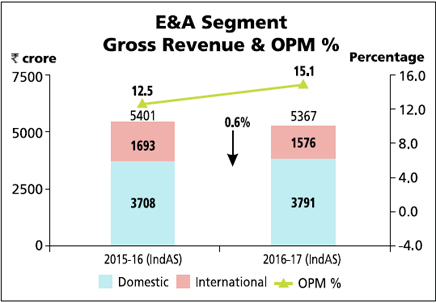

Normally, the Cost of goods that are sold can be compared to the company’s net sales. Direct costs normally include those specifically tied to a cost object, a product, a specified department, or even a project. Some industries, such as grocery stores, have much lower margins because they operate on fragile margins.

- Apart from excel, there are profit trackers which track sale price and cost and can calculate the profit and profit margin automatically.

- To interpret this percentage, we need to look at other similar companies in the same industry.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- GP analysis can also improve operations without weighing gross margins.

- A good long-term option is to redesign products so that they use less expensive parts or are less expensive to manufacture.

- This pool builder does not make high enough margins on fancy pools to be profitable.

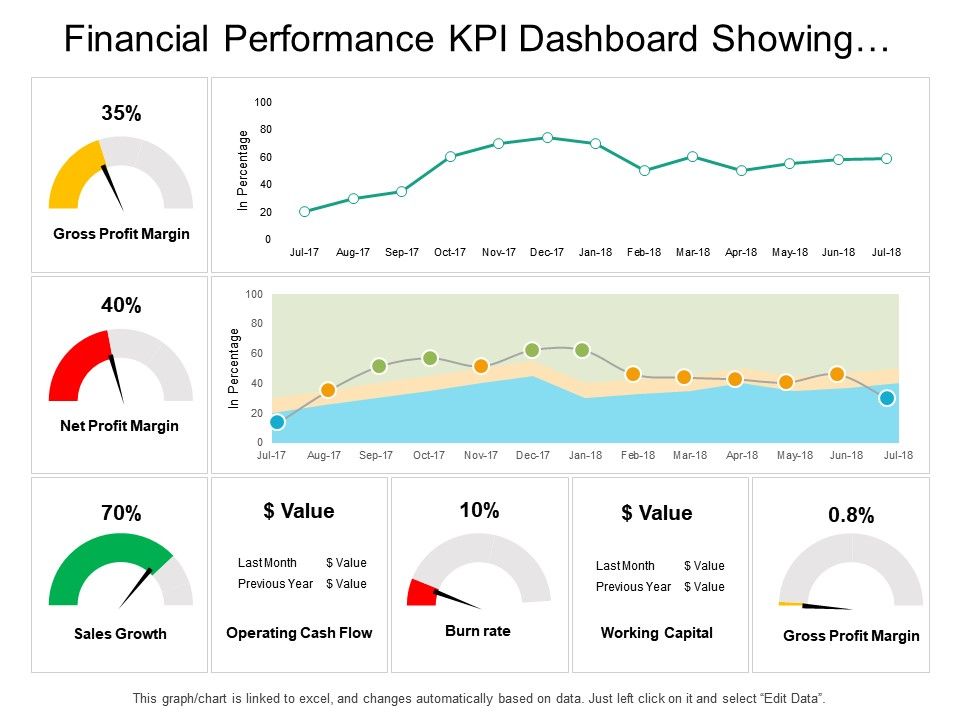

It will straight line depreciation your business’s gross margin and other financial metrics, compare your gross margin to other companies, and suggest improvements that lower costs and increase revenue. Every manager should analyze the most important financial ratios needed to improve business results. More often than not, they include gross margin in that profitability analysis.

So, she opens her accounting software and starts making some calculations. The Cost Of SalesThe costs directly attributable to the production of the goods that are sold in the firm or organization are referred to as the cost of sales. Let us understand the concept of finding gross profit percentage with the help of a couple of examples. Now, we could calculate the gross margin by reducing COGS from net sales. Closing InventoryClosing stock or inventory is the amount that a company still has on its hand at the end of a financial period.

Apple (AAPL) Gross Profit: Income Statement Example

The current quarter’s margin is most likely the result of economic and health factors rather than a genuine improvement in efficiencies. In other words, the dramatic increase to 95% is the result of external factors that have driven up technology sales. Expressed as a percentage, the net profit margin shows how much of each dollar collected by a company as revenue translates into profit. By considering the gross margin ratio of McDonald’s at the end of 2016 was 41.4%.

Step 2 → Next, we’ll calculate the gross profit by subtracting COGS from revenue. And understanding your retention rates is crucial.Retaincan dramatically improve your retention rates, as well as win back lost customers. For the last 12 months, the gross margin for technology has fluctuated between50% and 56%.

What is Gross Margin?

A high gross margin ratio can help a company in many different ways. This ratio is basically the company’s profit, which can be used to fuel any other of its parts. Retailers and wholesalers or distributors purchase items for inventory. The price they pay for their inventory items makes up most of their cost of goods sold on the balance sheet. As a result, they don’t incur any direct material or labor costs that would add to their cost of goods sold.

Comparing these two ratios will not provide any meaningful insight into how profitable McDonalds or the Bank of America Corporation is. For example, a legal service company usually reports a high gross margin ratio because it also operates in a service industry having low production costs. In contrast, this ratio can be lower for a car manufacturing company because of its high production costs. The gross profit margin is based on the company’s Cost of goods sold. We can compare it to the operating profit margin and net profit margin depending on the information you want. Like other financial ratios, it always be only valuable if we found any inputs into equation are basically to be found correct.

Or, to put it another way, a profit margin shows how much revenue a company can keep as profit. For example, a 60% profit margin would mean a company had a profit of $0.60 for every dollar of revenue generated. If your total revenue this week is $1,000 and your cost of goods sold is $700, then your gross profit margin would be 30%, and markup would be 42.9%. Since you know the cost of a product and you know the gross margin percentage to be achieved, you can determine the selling price and the markup needed. New and startup business owners need to monitor their company’s finances closely. Looking at your gross profit margin monthly or quarterly and keeping track of cash and inventory will help optimize your company’s performance.

Gross Margin Ratio Example

Display the inventory, the expenses are direct and inventoriable. For example, a restaurant buys ground beef to make hamburgers, and each burger takes four ounces of beef. The restaurant directly traces the cost of ground beef and the other ingredients in each serving. As a result, the restaurant knows how many ounces of beef they need to order to meet demand.

- Or, to put it another way, a profit margin shows how much revenue a company can keep as profit.

- For example, the same T-shirt company from before also pays for warehouse space, advertisements, and small business loan payments.

- The gross margin amount indicates how much money a company has to invest in growing the business.

- And understanding your retention rates is crucial.Retaincan dramatically improve your retention rates, as well as win back lost customers.

Either approach reduces the unit cost of goods, and so increases the gross margin ratio. This means that after Jack pays off his inventory costs, he still has 78 percent of his sales revenue to cover his operating costs. Assume Jack’s Clothing Store spent $100,000 on inventory for the year. Unfortunately, $50,000 of the sales were returned by customers and refunded.

Gross Profit Margin Formula Calculator

A high profit margin is one that outperforms the average for its industry. According to CFO Hub, retailers’ average gross profit margin is 24.27%. So, it turns out to be one of the primary factors to be checked when a better player from the same industry needs to be picked. Step 3 → Lastly, we’ll divide the gross profit of each company by the amount of revenue in the corresponding period to quantify the gross profit margin. Cost of Goods Sold → The direct costs incurred by a company that are directly tied to the production and delivery of specific goods and/or services . When calculating net margin and related margins, businesses subtract their COGS, as well as ancillary expenses.

It divides the gross profit by net sales and multiplies the result by 100. Gross margin ratio can be improved by finding cheaper inventory. Marking up goods will also lead to higher gross margin since there will be higher net sales.

Since it reveals the amount of profit made by a company after calculating the cost of products sold, it helps to reveal its financial strength and status. It also helps companies to make financial projections and future plans. Direct CostsDirect cost refers to the cost of operating core business activity—production costs, raw material cost, and wages paid to factory staff. Such costs can be determined by identifying the expenditure on cost objects. Next, the gross profit would be divided by revenue to get the gross margin.

Small business owners can also interpret their company’s financial ratios. A low margin indicates that the company has a lower product pricing and higher COGS and is struggling to generate profits. The gross profit method is essential because it shows investors and management how efficiently the business can produce and sell products.

For example, the profit margin ratio we mentioned takes into account other expenses as well, while the gross margin ratio does not. Revenue and cost of goods sold are two of the biggest balances in the income statement. If you can change either balance, you can increase the bottom line. On the other hand, operating expenses may be harder to reduce when dealing with fixed costs.

He provides a service for cutting customers’ lawns, trimming bushes and trees, and clearing lawn litter. For example, if we want to accumulate a profit of $500 and earn a contribution of $5 per unit, we must sell at least 100 units to meet our target. If there is not enough market for 100 units, we either need to decrease the production cost or increase the sales price.

Pivot Hinge Market [2023-2030] Highlighting Opportunities and … – Digital Journal

Pivot Hinge Market [2023-2030] Highlighting Opportunities and ….

Posted: Fri, 14 Apr 2023 10:45:02 GMT [source]

The hours, multiplied by the hourly pay rate, equal the direct labor costs per product. Direct costs are directly related to producing a product or delivering a service. Gross profit margin is a valuable financial metric because it measures a company’s ability to turn revenue into profit. You can also talk about your experience with profit margins in your cover letter. For example, if your relative has a small business and you helped them look at their profit margins to find areas where cutting costs would have a big impact, mention that.

Global Hydrophone Market [2023-2030] Comprehensive Research – Digital Journal

Global Hydrophone Market [2023-2030] Comprehensive Research.

Posted: Fri, 14 Apr 2023 10:45:02 GMT [source]

A further concern is that the costs that go into the calculation of net price can include some fixed costs, such as factory overhead. When this is the case, the gross profit margin will be quite small (or non-existent) when sales are low, since the fixed costs must be covered. As sales volume increases, the fixed cost component is fully covered, leaving more sales to flow through as profit. Thus, the gross margin ratio is more likely to be low when sales volume is low, and increases as a proportion of sales as the unit volume increases. This effect is less evident when the fixed cost component is quite low. The gross profit margin is a calculation used to measure a company’s financial performance.

The gross profit margin formula, which divides the gross profit by net sales, is a vital indicator of a company’s financial health. With a higher gross margin ratio, the management of a company is sure that their business is selling its inventory at a higher profit percentage. There are two ways through which a company/ business can have a high gross margin ratio. First of all, a company can buy its inventory quite cheap – especially when buying from the wholesaler or manufacturer, as they can grant their buyers a purchase discount.

The Berry https://1investing.in/ measures a company’s gross profit to operating expenses. Used in transfer pricing methods, this ratio is a financial indicator. If a company sells its products at a premium, with all other things equal, it has a higher gross margin. But this can be a delicate balancing act because if a company sets its prices overly high, fewer customers may buy the product, and the company may consequently hemorrhage market share. The gross margin ratio is often get confused with a profit margin ratio. In other words, mainly a gross profit ratio is a essentially the percentage a markup on any merchandise from a Cost.

دالاس للتكييف وفلاتر المياه وقطع الغيار

دالاس للتكييف وفلاتر المياه وقطع الغيار